White sugar: The high futures price dropped slightly, and the spot market was relatively stable

Analysis of white sugar futures:On December 2, the opening price of the SR501 contract: 6109, the highest price: 6125, the lowest price: 6050, the position: 293454, the settlement price: 6090, yesterday's settlement: 6082, up: 8, daily trading volume: 382818 lots.

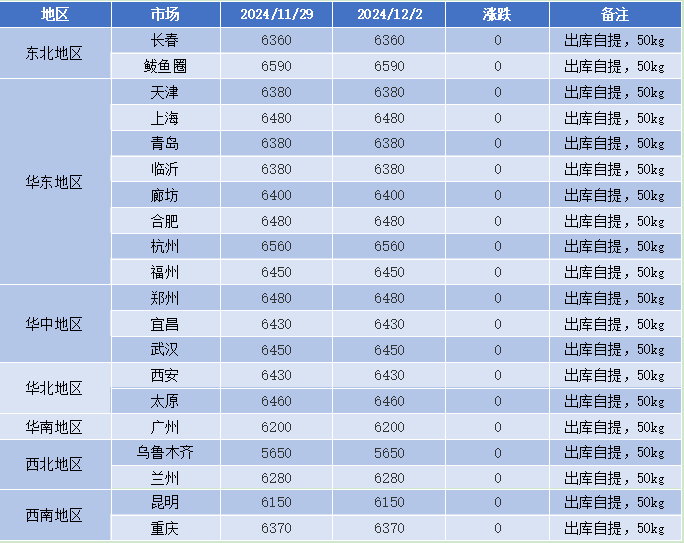

Comprehensive price list by region: RMB/ton

White sugar spot market:Today, the mainstream transaction price in China's white sugar market is stabilizing. Among them, 6,360 - 6,590 yuan/ton in Northeast China and 6,380 - 6,560 yuan in East China/ton, Central China 6430-6480 yuan/ton, North China 6430-6460 yuan/ton, South ChinaThe region is 6200 yuan/ton, the northwest region is 5,650 - 6,280 yuan/ton, and the southwest region is 6,150 - 6,370 yuan/ton. Price of white sugar companies: The price of first-class white sugar in Kunming, Nanhua, is 6210 yuan/ton, which is stable. Nanhua Xiangyun and Dali first-grade white sugar quoted at 6160 yuan/ton, which is stable. The price of first-grade white sugar in Yun County in Nanhua is 6040 yuan/ton, which is stable. Nanhua Guangxi's first-grade white sugar price is 6170 yuan/ton, down 10 yuan/ton. Yingmao Kunming first-grade white sugar quoted at 6210 yuan/ton, which is stable. Yingmao Dali's first-grade white sugar price is 6110 yuan/ton, which is stable. Yingmao Dafeng first-class white sugar trader quoted 6700 yuan/ton, which is stable. COFCO (Tangshan) Sugar Co., Ltd. quoted 6670 yuan/ton for imported processed sugar, which is stable. COFCO (Liaoning) Sugar Co., Ltd. quoted 6600 yuan/ton for imported processed sugar, which is stable.

White sugar market outlook forecast:In the international market, the year-on-year decline in sugar production in central and southern Brazil in the first half of November temporarily supported raw sugar futures, but the downward revision of the supply gap in the 2024/25 crop season and Brazil's expectation of increasing production drove raw sugar to decline. ChinaThe night price of the main contract of white sugar 2501 weakened within a narrow range. The early trading price first fluctuated and then quickly pulled down to the lowest point of 6050, while the afternoon trading price made up for part of the decline and rebounded. In terms of transactions, the opening was 20.0% higher than the opening was 20.4% lower. The technical level shows that the three-track opening of the Bollinger Band (13, 13, 2) continues to open. The candle chart shows a negative column, and the two lines of the MACD line at the daily level show a golden cross trend. The expected tightening of import controls on syrup and ready-mixed flour supports Zheng sugar futures, but the fundamentals are still weak, supply pressure is high, futures prices have limited increase, spot market sugar prices have been adjusted cautiously, and downstream procurement has waited and seen new sugar still exists. Overall, white sugar futures are expected to fluctuate mainly in a narrow range in the short term.

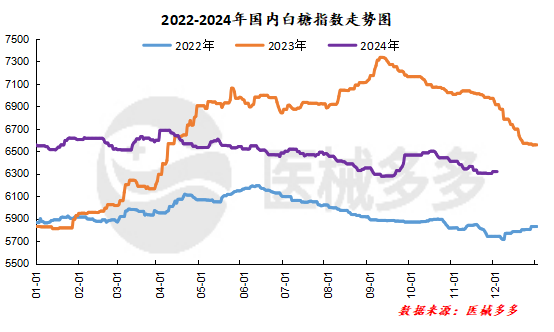

China's white sugar index:According to calculations from medical equipment,December 2China's white sugar spot index was 6319.14, up 0.00%, or 0.00%, and the white sugar index was flat.

Position Dragon and Tiger List

The information provided in this report is for reference only.

Original: Wang Yaoxin 17732561807